INReport is a centralized RegTech solution that automates regulatory report submission to Regulatory Bodies. It provides the facility to generate reports by integrating the interface with its source system. It can extract data from source systems messages and merge it with required business rules and reporting logic, thus transforming it into the desired file format.

INReport e-Invoice is a real-time solution that is tailored for the IT backend environment that requires centralization on LHDN e-invoice management for TaxPayer Proof of Income & Proof of Expenses. A business entity with Multiple Sources/ERP/Accounting Systems. Holdings company would like to have a centralized e-invoicing system across all subsidiaries. Foreign brand ERP that does not have e-invoice solutions. A legacy system that needs to comply with LHDN e-invoice. Looking for an extensive solution that would cover Malaysia’s upcoming GST requirement.

INReport e-Invoice complies with real-time transactional requirements on e-invoicing for B2B, B2C & B2G regulatory requirements. Requirement that the Inland Revenue Board of Malaysia (IRBM), also known as the Lembaga Hasil Dalam Negeri Malaysia (LHDN), be presented to administer business transactions and to improve the management of Malaysia’s tax administration.

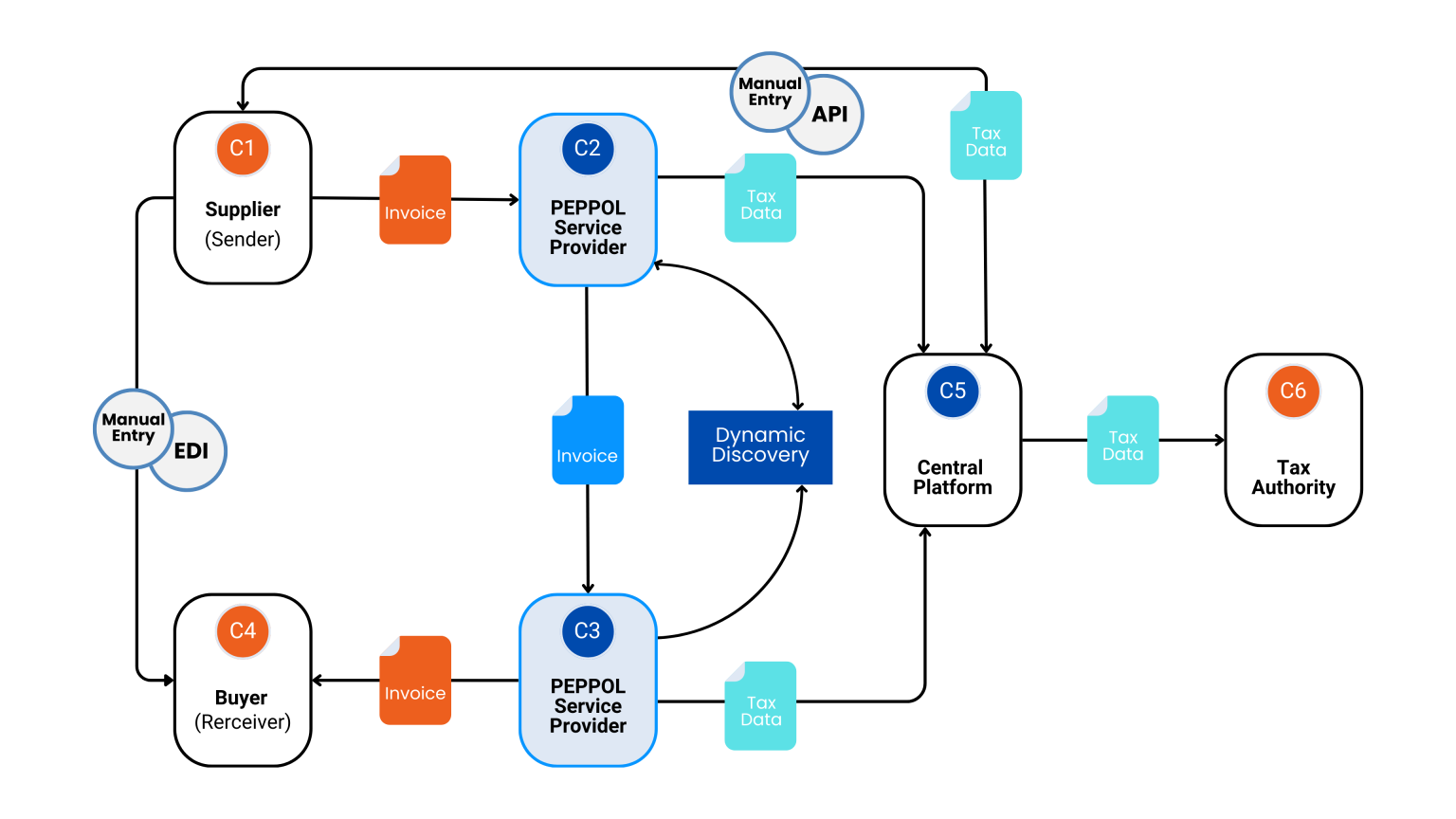

We comply with the e-Invoice model via API for the latest tax regulations and tax reporting requirements by LHDN. We are dynamic & support future incremental requirements, including the extension to GST.

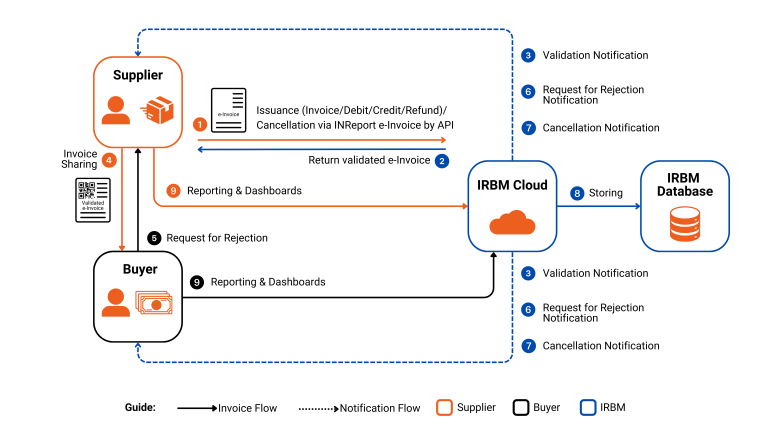

Taxpayer as the Supplier E-invoice Pre-Submission (Digital Certificate)

E-invoice Submission (Invoice/Debit/Credit/Refund)

E-invoice Validation – UIN & invoice data validation, 72 hours real-time validation with Supplier or Buyer via LHDN)

E-invoice Notification

Sharing of e-invoice (final e-invoice with QR code)

Rejection and Cancellation (Buyer rejection, Supplier cancellation)

TIN & UIN Management

where goods are shipped to a different recipient and/or address

We compile and aggregate into one reporting format:

We provide real-time monitoring of invoicing and tax-related activities.

We accommodate the growth of businesses or government direction: For business: Allowing the addition of new requirements / Tax reporting submissions to comply/submit (GST) For IT: Cloud readiness, scalable

We generate comprehensive and customizable reports that cater to specific business needs and assist in preparing accurate tax filings attached with QR codes.

Centralized Taxpayer Identification Number, provides real-time enquiries.

A centralized module that keeps track of the Unique Identifier Number provided by IRBM per invoices.